GBPCAD analysis for 04.04.2024

Time Zone: GMT +2

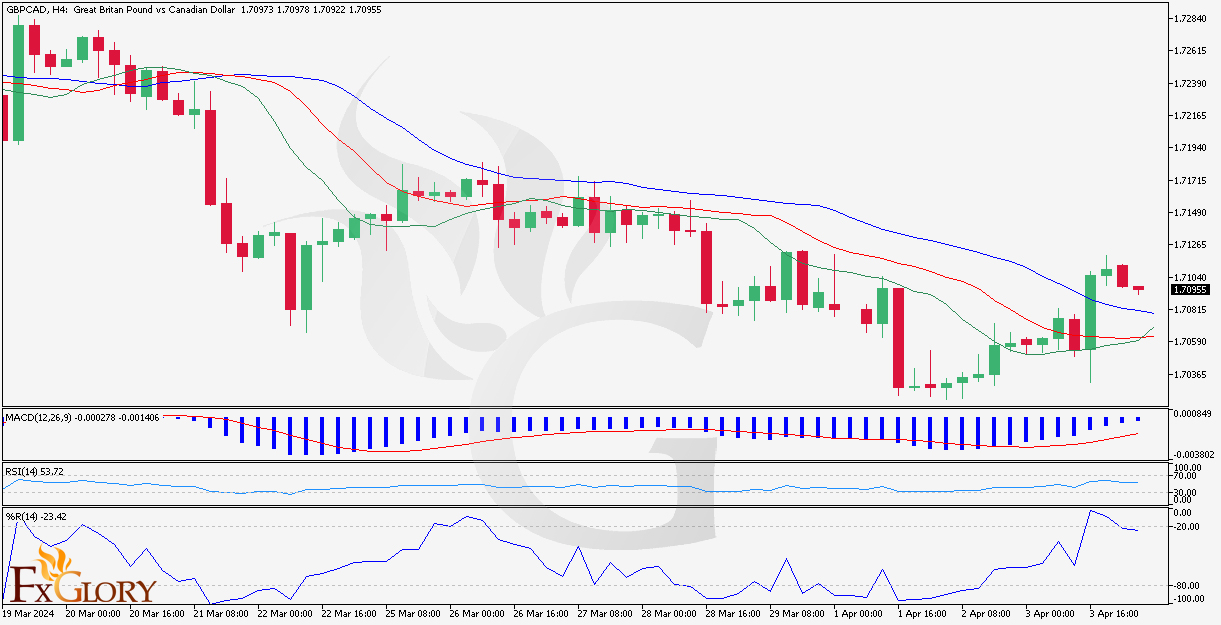

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GBPCAD pair reflects the economic interplay between the United Kingdom and Canada. Factors influencing the pair include differences in interest rates set by the Bank of England and the Bank of Canada, oil prices due to Canada's status as a major oil exporter, and political events such as Brexit negotiations. Economic data releases from both countries, such as employment reports, GDP growth rates, and trade balance data, also provide critical insight into the currency pair's movements.

Price Action:

The GBPCAD H4 chart displays a recent bearish trend with the price consistently closing below the moving averages, indicating a potential continuation of the downtrend. The series of lower highs and lower lows suggests that the bears are in control. Currently, the price seems to be in a slight retracement phase, possibly seeking equilibrium before the next move.

Key Technical Indicators:

Alligator: The Alligator lines are intertwined, indicating a phase of consolidation; however, the price staying below these lines could signal that the downtrend might resume.

MACD (Moving Average Convergence Divergence): The MACD line is below the signal line, and the histogram bars are decreasing in height, which supports the bearish momentum.

RSI (Relative Strength Index): The RSI is positioned around the midpoint at approximately 53, which is neutral, suggesting neither overbought nor oversold conditions.

William's %R: The indicator is hovering around -23, which does not denote an extreme of market sentiment, aligning with the RSI's neutral stance.

Support and Resistance:

Support: The nearest support level is potentially around the recent swing low seen on the chart.

Resistance: Resistance can be identified at the recent swing high, where price reversed to continue the downtrend.

Conclusion and Consideration:

The GBPCAD pair, in the H4 timeframe, appears to be in a bearish trend with a short-term consolidation. The key technical indicators present a mixed sentiment with a slight bearish inclination. It’s important to monitor upcoming economic reports from both the UK and Canada that could inject volatility and potentially drive new trends. Traders should consider maintaining flexible strategies, incorporating stop losses, and adjusting to shifts in fundamental factors impacting this currency pair.

Disclaimer: This analysis is intended for informational purposes only and should not be construed as investment advice. Decisions should be made based on individual research and risk tolerance.

FxGlory

04.04.2024

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GBPCAD pair reflects the economic interplay between the United Kingdom and Canada. Factors influencing the pair include differences in interest rates set by the Bank of England and the Bank of Canada, oil prices due to Canada's status as a major oil exporter, and political events such as Brexit negotiations. Economic data releases from both countries, such as employment reports, GDP growth rates, and trade balance data, also provide critical insight into the currency pair's movements.

Price Action:

The GBPCAD H4 chart displays a recent bearish trend with the price consistently closing below the moving averages, indicating a potential continuation of the downtrend. The series of lower highs and lower lows suggests that the bears are in control. Currently, the price seems to be in a slight retracement phase, possibly seeking equilibrium before the next move.

Key Technical Indicators:

Alligator: The Alligator lines are intertwined, indicating a phase of consolidation; however, the price staying below these lines could signal that the downtrend might resume.

MACD (Moving Average Convergence Divergence): The MACD line is below the signal line, and the histogram bars are decreasing in height, which supports the bearish momentum.

RSI (Relative Strength Index): The RSI is positioned around the midpoint at approximately 53, which is neutral, suggesting neither overbought nor oversold conditions.

William's %R: The indicator is hovering around -23, which does not denote an extreme of market sentiment, aligning with the RSI's neutral stance.

Support and Resistance:

Support: The nearest support level is potentially around the recent swing low seen on the chart.

Resistance: Resistance can be identified at the recent swing high, where price reversed to continue the downtrend.

Conclusion and Consideration:

The GBPCAD pair, in the H4 timeframe, appears to be in a bearish trend with a short-term consolidation. The key technical indicators present a mixed sentiment with a slight bearish inclination. It’s important to monitor upcoming economic reports from both the UK and Canada that could inject volatility and potentially drive new trends. Traders should consider maintaining flexible strategies, incorporating stop losses, and adjusting to shifts in fundamental factors impacting this currency pair.

Disclaimer: This analysis is intended for informational purposes only and should not be construed as investment advice. Decisions should be made based on individual research and risk tolerance.

FxGlory

04.04.2024